Join Palmetto Citizens

Become a member today and enjoy better rates, fewer fees and the personalized service we’ve been providing to Midlands residents since 1936.

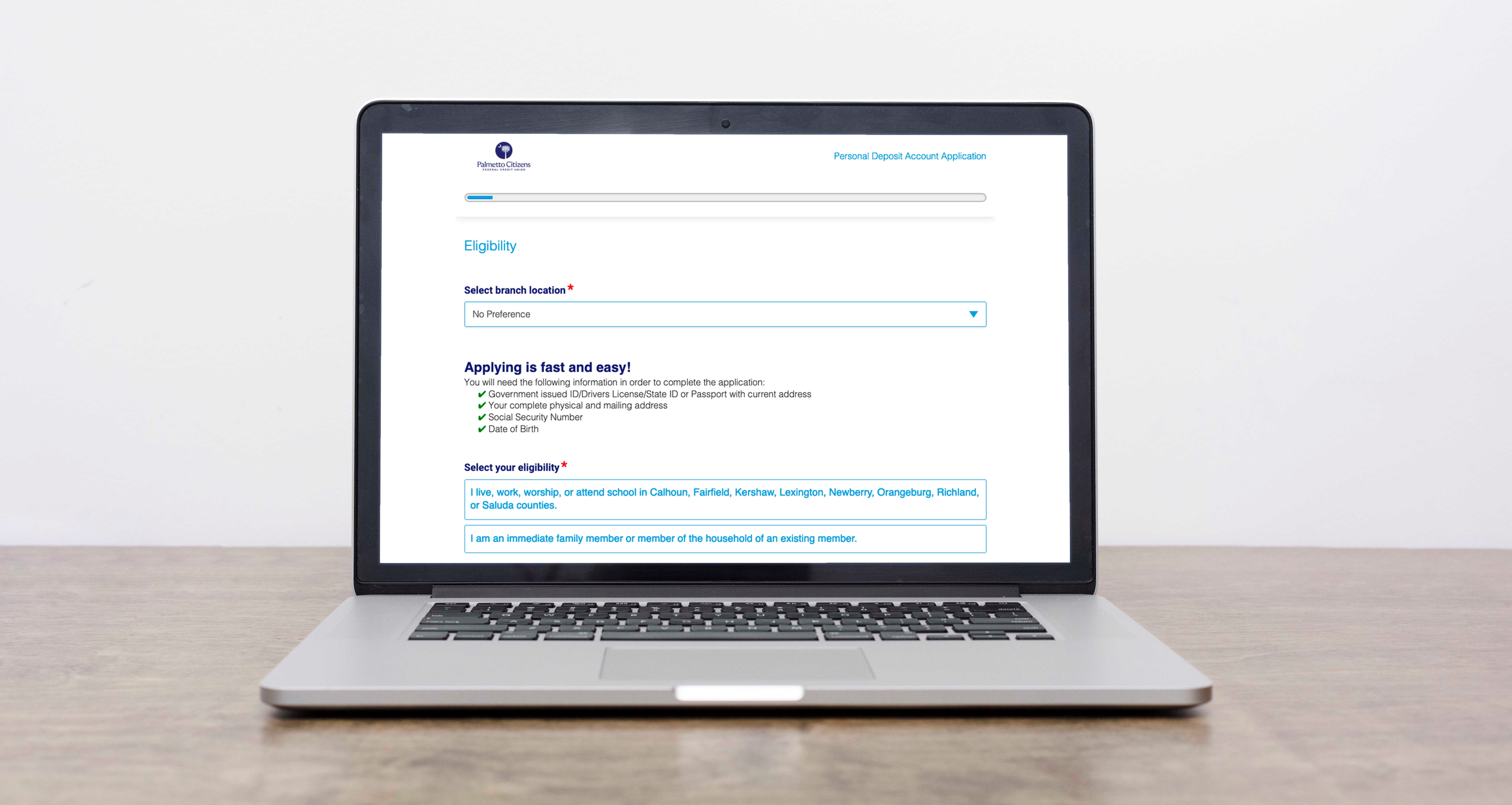

Online Membership Application

Related Links

For Further Assistance

If you need additional help, our staff is available to you. Contact us using any of the methods below.

Hours of operation:

Monday - Thursday, 9am - 5pm ET

Friday, 9am - 6pm ET

Book an appointment with our staff

Log in to send a Help Desk message

Phone: (803) 732-5000

Join Online Today!

Join Online Today!

To begin your credit union relationship, simply open a savings account with as little as $5 by completing our online application or visiting any of our branches. You can also choose to open a checking account, additional savings accounts or apply for a loan.

Once your membership has been opened, you are able to take advantage of all benefits that come with being a Palmetto Citizens member.

Online membership applications are now available for all personal accounts.

Membership Eligibility

Individuals who have a connection to most of the nine counties surrounding the Midlands of South Carolina (Calhoun, Fairfield, Kershaw, Lexington, Newberry, Orangeburg, Richland, Saluda, and Sumter) are eligible to join Palmetto Citizens. This includes those who live, work, worship, attend school, or volunteer in these areas.

We also have a partnership with the Carolina Consumer Council (CCC), a nonprofit organization focused on consumer advocacy and financial education, which allows anyone living in SC, NC, GA, TN, or VA to join Palmetto Citizens! Membership to the CCC is free when joining Palmetto Citizens and they won't contact our members or use or sell their information.

Membership is also available to businesses, non-profits, churches, and legal entities. Immediate family of current Palmetto Citizens members are also eligible to join.

The Credit Union Difference

As a credit union, we’re a not-for-profit financial institution. That means we, unlike banks, do not have to pay earnings to stockholders. Instead, we return profits back to our member-owners as lower loan rates, higher savings rates and fewer fees.

When you borrow and save with Palmetto Citizens, you are also keeping your money locally. That means we’re able to assist more of your neighbors, area small businesses and local charitable causes.

Funds deposited in our credit union are federally insured by a fund backed by the full faith and credit of the U.S. government. As the FDIC does for banks, the National Credit Union Share Insurance Fund (NCUSIF) insures savings of at least up to $250,000 per account. The NCUSIF is administered by the National Credit Union Administration (NCUA), an agency of the federal government.

The History of Palmetto Citizens

Palmetto Citizens Federal Credit Union, formerly known as Columbia (SC) Teachers FCU, was organized and issued a federal charter on June 4, 1936. Ten individuals each deposited $5.00 to begin the credit union which only served the employees of Columbia Public Schools.

In 2001, the National Credit Union Administration (NCUA), an agency of the federal government that oversees all federally chartered credit unions, gave approval for us to become a community based credit union and officially became Palmetto Citizens. We were the first credit union in South Carolina to be granted a multi-county community charter.

Today, Palmetto Citizens is one of South Carolina's larger credit unions, serving over 80,000 members with assets of over $1.3 billion.

Equality for All

In accordance with federal laws and U.S. Department of the Treasury policy, this organization is prohibited from discriminating on the basis of race, color, national origin, sex, age, or disability.

To file a complaint of discrimination, write to:

U.S. Department of the Treasury,

Director, Office of Civil Rights

and Equal Employment Opportunity

1500 Pennsylvania Avenue, N.W.,

Washington, DC 20220;

call (202) 622 - 1160;

or send an e-mail to: crcomplaints@treasury.gov.

De acuerdo a lo establecido por las leyes federales y las políticas del Departamento del Tesoro esta organización no puede discriminar por causa de raza, color, origen nacional, sexo, edad, o porque una persona tiene impedimentos.

Para presentar una queja sobre discriminación, escriba a:

U.S. Department of the Treasury,

Director, Office of Civil Rights

and Equal Employment Opportunity

1500 Pennsylvania Avenue, N.W.,

Washington, DC 20220;

llame al (202) 622-1160;

o envíe un correo electrónico a: crcomplaints@treasury.gov.

Equal Opportunity for All

Related Links

For Further Assistance

If you need additional help, our staff is available to you. Contact us using any of the methods below.

Hours of operation:

Monday - Thursday, 9am - 5pm ET

Friday, 9am - 6pm ET

Book an appointment with a staff member

Log in to send a Help Desk message

Phone: (803) 732-5000

PATRIOT Act: To comply with the USA PATRIOT Act, Palmetto Citizens is required to verify the identity of members applying for membership and opening new accounts or services. Information we are required to obtain includes name, mailing and residence address, date of birth and a copy of a government issued photo ID. Additional information may also be gathered depending on the type of account applied for or opened. Identification and information on existing members will be gathered as they open or use additional services offered by the credit union. Confidentiality of the information gathered and used by Palmetto Citizens will be maintained as required under the Privacy Act.